42 how to solve sales tax

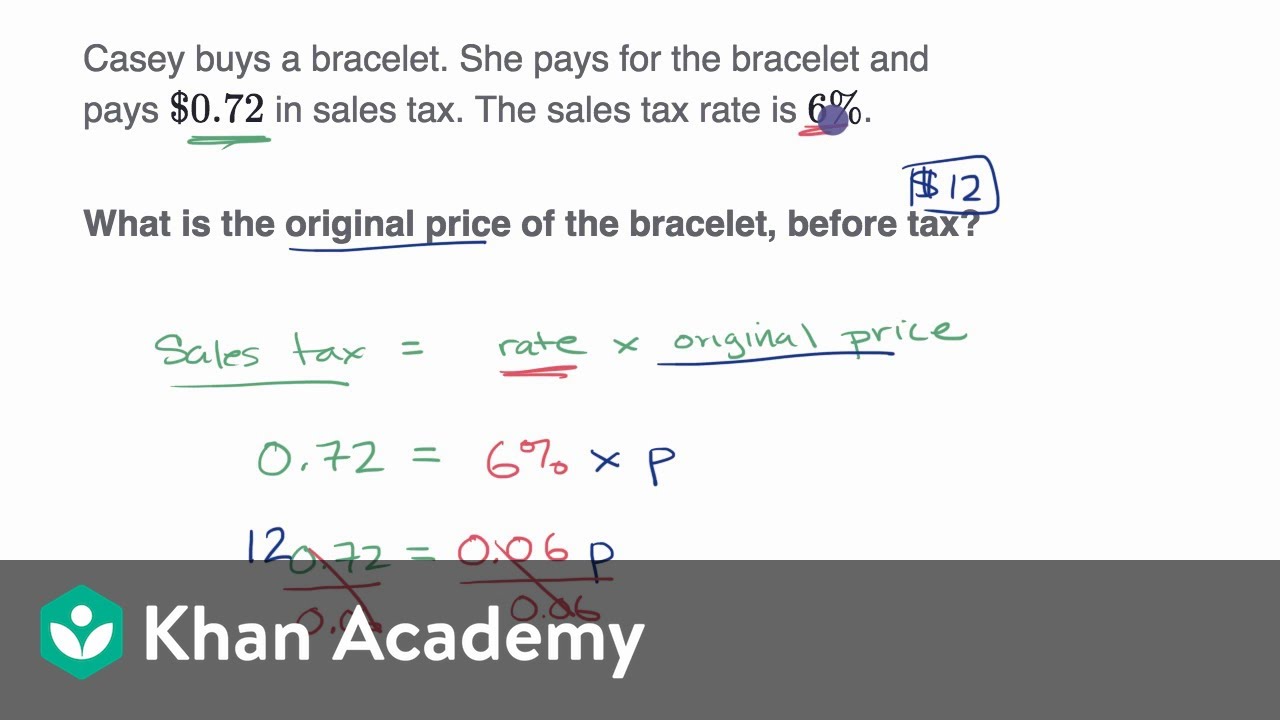

How to Solve Sales Tax Using Equations - Pocketsense If you have the total purchase price and the price without tax, you can use a sales tax equation to figure out the sales tax and the sales tax rate. Find the dollar amount of the sales tax by subtracting the pretax price from the post-tax price. Sales Tax - Free Math Videos Online Solution: The sales tax = Final price - price before tax = $74.20 - $70.00 = $4.20 Sales tax = sales tax rate x price before tax $4.20 = sales tax rate x $70 The sales tax rate = 4.20 / 70 = 0.06 = 6% Return from the Sales Tax page to Money Math

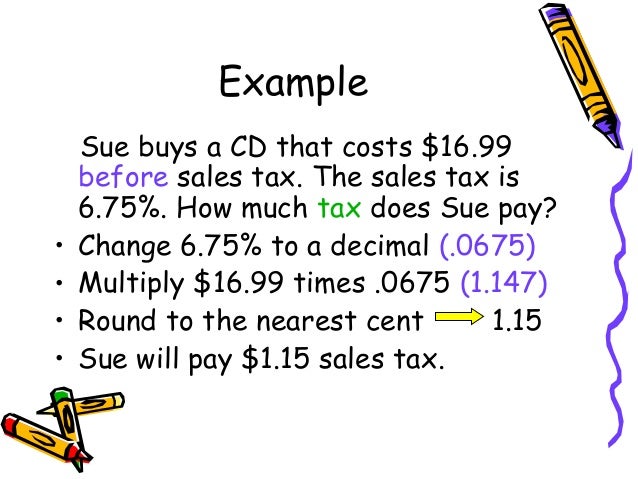

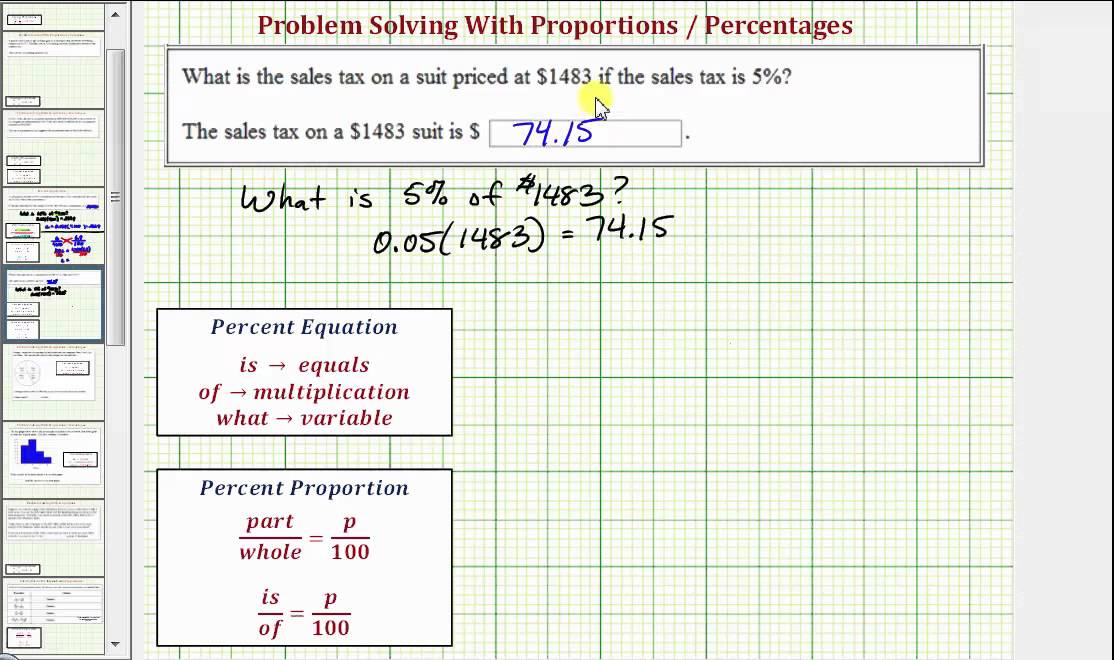

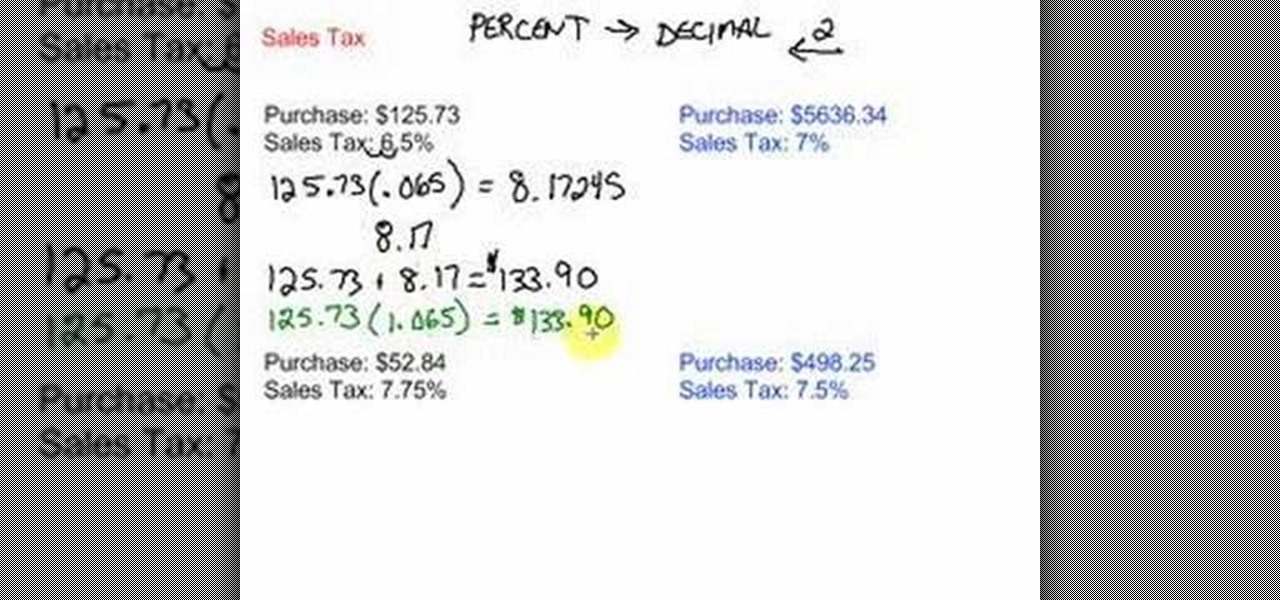

Percent Problems involving Taxes (with videos, worksheets ... Finding Sales Tax This video walks through a one and two-step method for finding sales tax. It includes 4 examples.

How to solve sales tax

Sales Tax Decalculator - Formula to Get Pre-Tax Price from ... How the sales tax decalculator works. The Excel sales tax decalculator works by using a formula that takes the following steps: Step 1: take the total price and divide it by one plus the tax rate. Step 2: multiply the result from step one by the tax rate to get the dollars of tax. Step 3: subtract the dollars of tax from step 2 from the total price. How to Calculate Sales Tax | Definition, Formula, & Example Use the following formula to calculate sales tax: To determine how much sales tax to charge, multiply your customer's total bill by the sales tax rate. Example Let's say your business is located in Cleveland, Ohio. You don't have a secondary business location. How to solve sales tax math problems - Quora In order to solve sales tax math problems, it is best to know the rate of the tax. Then using a calculator figure out the tax and add it to the price of the item. Each state has a different tax rate.

How to solve sales tax. Sales Tax - Solving Math Problems Sales tax = 8% of total spent. Total Cost of furniture = cost of chairs + cost of tables + sales tax. Cost of furniture without sales tax. Cost of furniture without sales tax = (number of chairs)* ($24.95 per chair) + (number of tables)* ($42.50 per table) 4 Ways to Calculate Sales Tax - wikiHow How to Calculate Sales Tax Method 1 Method 1 of 4: Calculating Total Cost. Multiply the cost of an item or service by the sales tax in order to... Method 2 Method 2 of 4: Examples. Try this example. You're buying a basketball in the state of Colorado, where sales tax... Method 3 Method 3 of ... Calculating equilibrium and surplus with a tax, a question ... b) A tax of 15 per unit sold is now imposed on every unit sold. Calculate the new equilibrium price (including tax) and quantity, the tax quantity raised and the dead weight loss caused by the tax. To solve part a) we need to follow the steps in calculating equilibrium price and quantity. Sales Tax Calculator The Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price. Related VAT Calculator What is Sales Tax? A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

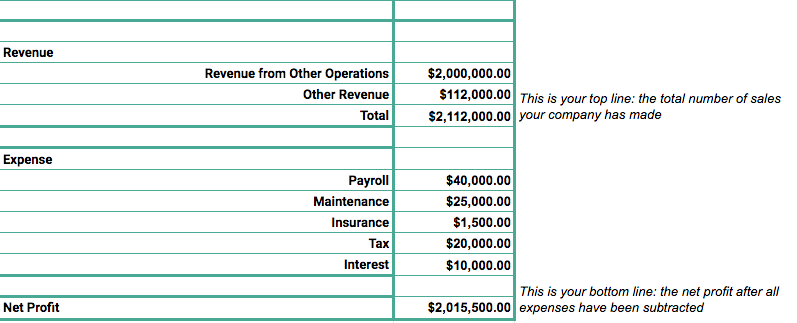

How to find the amount of sales tax - Algebra 1 First, subtract the pre-tax value from the total cost of the items to find the sales tax cost. Next, create a ratio of the sales tax to the pre-tax cost of the items. Last, create a proportion where the pre-tax value is proportional to 100% and solve for the percentage of sales tax. Cross multiply and solve. How to Calculate Sales Revenue: Definition & Formula ... Sales Revenue = 400 x $350. Sales Revenue = $140,000. By selling 100 units less in a year, your sales revenue drops by $35,000 this year. However, if your sales increase this year to 600 units ... How to Calculate sales tax in algebra « Math - WonderHowTo In this math lesson we will learn how to solve math problems involving sales tax. Remember these two important formulas: Final price = price before tax + sales tax Sales tax = sales tax rate x price before tax Want to master Microsoft Excel and take your work-from-home job prospects to the next level? 42 How To Solve Sales Tax - Edublog Solution for Schools › algebra_1-help › how-to-findHow to find the amount of sales tax - Algebra 1 Last, create a proportion where the pre-tax value is proportional to 100% and solve for the percentage of sales tax. Cross multiply and solve. Isolate the sales tax percentage to the left side of the equation by dividing each side by the pre-tax value.

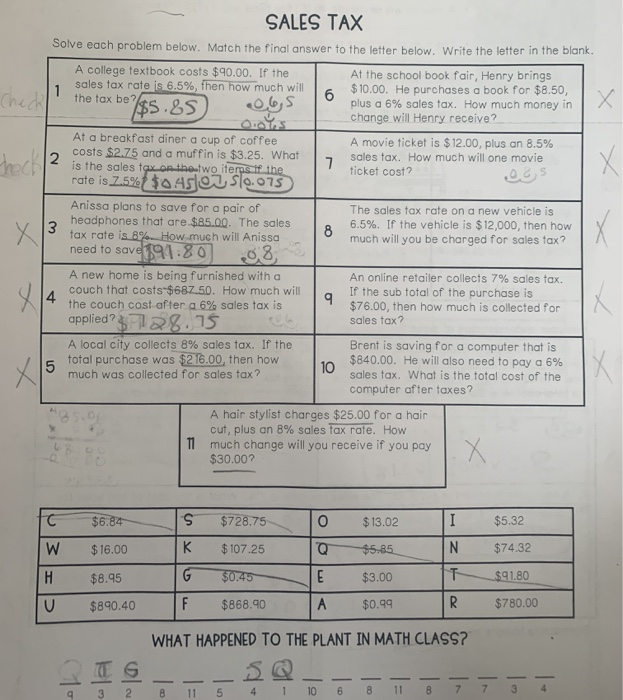

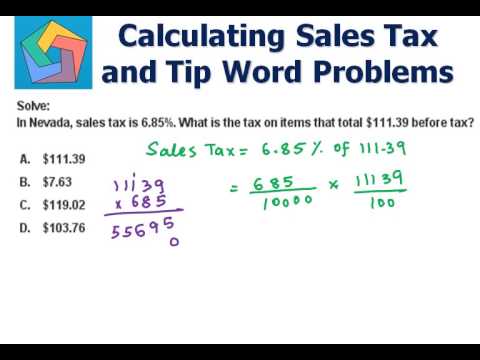

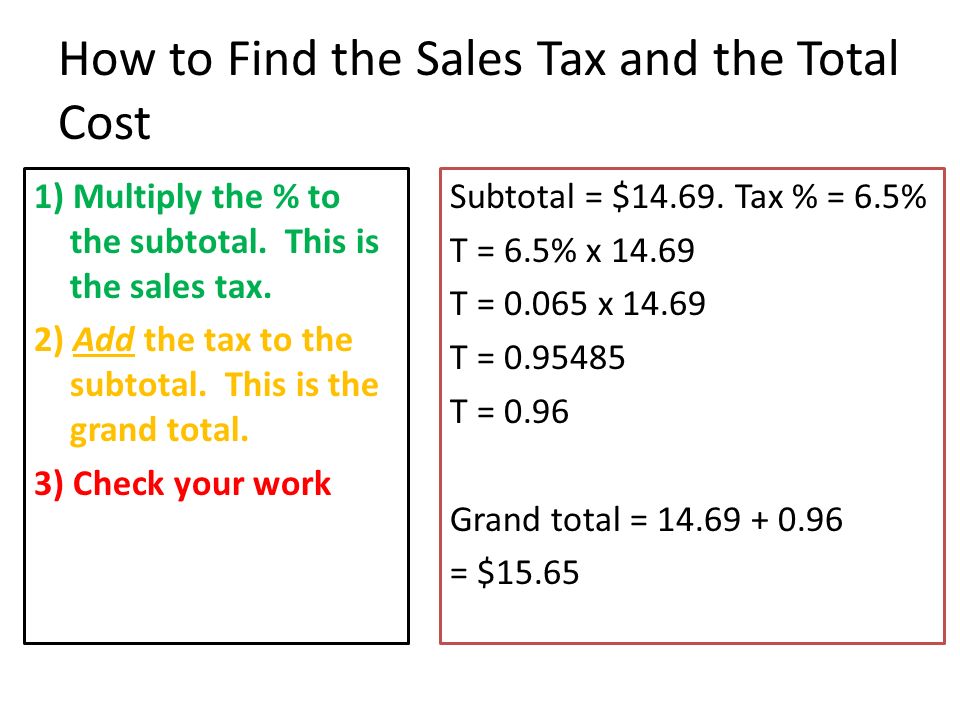

How To Solve Sales Tax Problems? (TOP 5 Tips) What is the formula for calculating sales tax? Multiply the cost of an item or service by the sales tax in order to find out the total cost. The equation looks like this: Item or service cost x sales tax (in decimal form) = total sales tax. Add the total sales tax to the Item or service cost to get your total cost. Solving Problems involving Sales Tax, Commission, Discount ... Solving Problems involving Sales Tax, Commission, Discount and Interest Sales Tax: Sales TaxSales TaxSales Tax = Sales tax rate (as a decimal) × Purchase price Total price = Purchase price + sales tax Total price Calculating input and output value-added tax (VAT ... Output value-added tax (output VAT) is 800,000 x 10% = VND 80,000. When making invoices for selling goods or services, business establishments must clearly state the pre-tax sale prices, value added tax and the total amount of money the buyer must pay. 4 Ways to Solve a Sales Tax Issue - Refund Retriever If you find yourself with a sales tax issue, take a deep breath and try not to panic. You have lots of options for help solving it. Try Your State's Website Your state's tax assessor's website has lots of information to help you. Many of them have both the literal law and the layman's terms translations on their websites for you.

PDF How to calculate Discount and Sales Tax How much does that ... Sales Tax is given as a percentage and varies from state to state. In the year 2005, sales taxes range from 4% - 8%. For our lesson today we will assume Sales Tax = 5%. We will use the following formula to calculate the sales tax: Sales Tax = Sales Tax rate * Sale Price In our example we found the Sale Price to be $17.21 and we will use a Sales ...

Sales Tax Calculator Calculator Use. Calculate a simple single sales tax and a total based on the entered tax percentage. For State, Use and Local Taxes use State and Local Sales Tax Calculator. Net Price is the tag price or list price before any sales taxes are applied.. Total Price is the final amount paid including sales tax.. Sales Tax Calculations:

how to solve sales tax, total amount, and rate of sales ... please subscribe to my channel,markmysam channelhow to solve sales tax, total amount, and rate of sales tax,a video lesson on how to solve sales tax, total a...

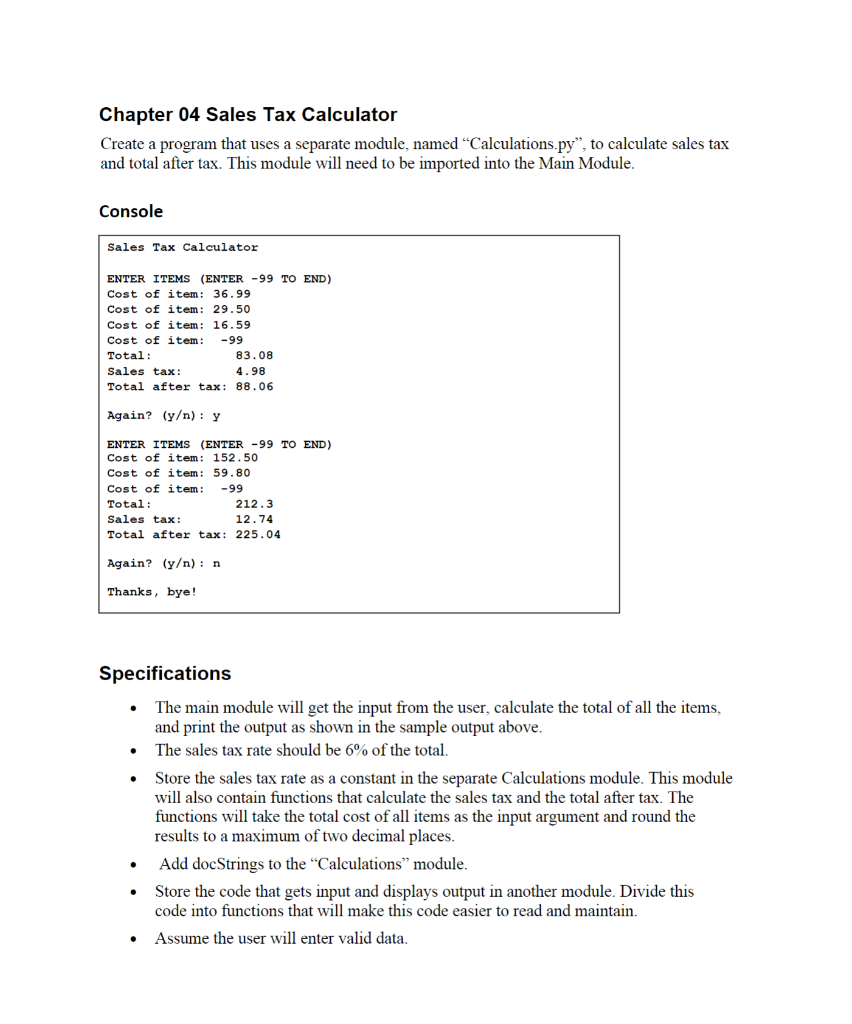

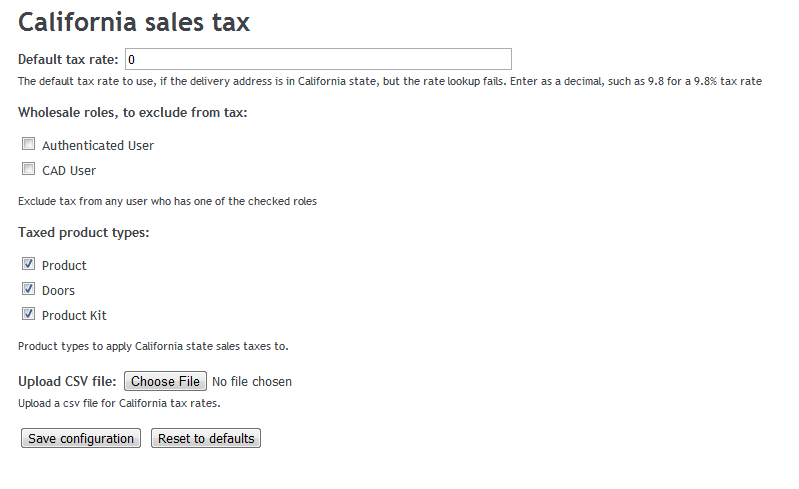

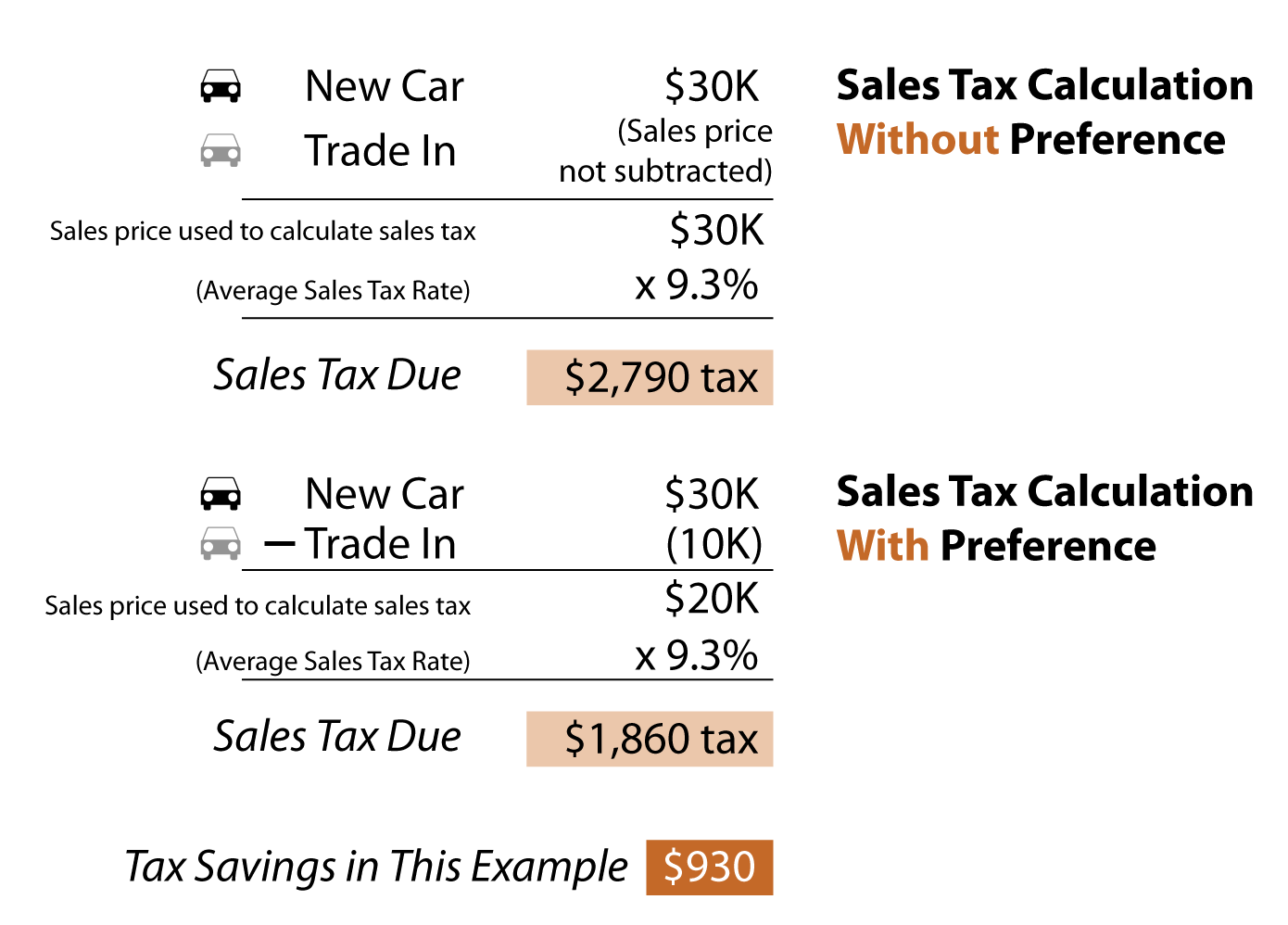

6.3 Solve Sales Tax, Commission, and Discount Applications ... In many parts of the United States, sales tax is added to the purchase price of an item. See Figure 6.7. The sales tax is determined by computing a percent of the purchase price. To find the sales tax multiply the purchase price by the sales tax rate. Remember to convert the sales tax rate from a percent to a decimal number.

Solving Sales Tax Applications | Prealgebra The sales tax is determined by computing a percent of the purchase price. To find the sales tax multiply the purchase price by the sales tax rate. Remember to convert the sales tax rate from a percent to a decimal number. Once the sales tax is calculated, it is added to the purchase price.

Sales Tax & Discount - Middle School Math - YouTube In this video I demonstrate how to compute sales tax & discounts.Thanks for watching. My website is .

Free Step-by-Step Sales Tax Lesson with Interactive ... Analysis: Sales tax is the difference between the amount of the total bill and the price of the item. If we divide the sales tax by the price of the item, we get the sales tax rate. Solution: $17.68 - $17.00 = $0.68 and ($0.68) ÷ ($17.00) = 0.04. Answer: The sales tax rate is 4%.

How do I calculate the amount of sales tax that is ... Sales Tax Calculation To calculate the sales tax that is included in a company's receipts, divide the total amount received (for the items that are subject to sales tax) by "1 + the sales tax rate". In other words, if the sales tax rate is 6%, divide the sales taxable receipts by 1.06.

41 How To Solve Sales Tax - #1 Educational Info Blog How do I calculate the amount of sales tax that is... | AccountingCoach Sales Tax Calculation To calculate the sales tax that is included in a company's receipts, divide the total amount received (for the items that are subject to sales tax) by. We solve for S by dividing $481.50 by 1.07. The result is that the true product sales amounted to $450.

How to solve sales tax equations - Solve-variable Solve-variable.com offers practical information on how to solve sales tax equations, solving equations and precalculus and other algebra subjects. In the event that you need guidance on arithmetic or syllabus for college algebra, Solve-variable.com is undoubtedly the perfect place to check-out!

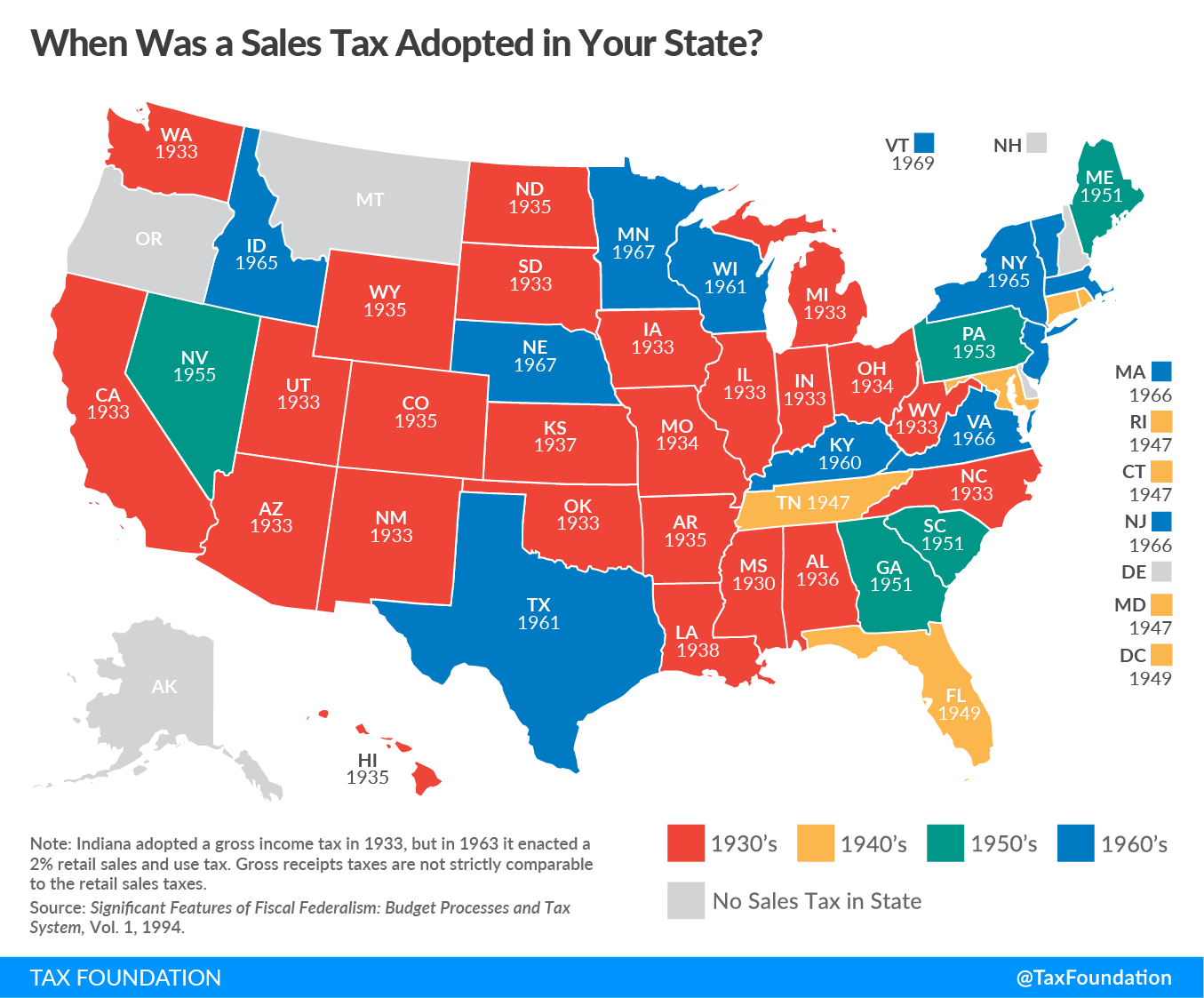

How to solve sales tax math problems - Quora In order to solve sales tax math problems, it is best to know the rate of the tax. Then using a calculator figure out the tax and add it to the price of the item. Each state has a different tax rate.

How to Calculate Sales Tax | Definition, Formula, & Example Use the following formula to calculate sales tax: To determine how much sales tax to charge, multiply your customer's total bill by the sales tax rate. Example Let's say your business is located in Cleveland, Ohio. You don't have a secondary business location.

Sales Tax Decalculator - Formula to Get Pre-Tax Price from ... How the sales tax decalculator works. The Excel sales tax decalculator works by using a formula that takes the following steps: Step 1: take the total price and divide it by one plus the tax rate. Step 2: multiply the result from step one by the tax rate to get the dollars of tax. Step 3: subtract the dollars of tax from step 2 from the total price.

0 Response to "42 how to solve sales tax"

Post a Comment